We're Your One-Stop Mortgage Headquarters

Whether you’re buying or refinancing your first, second, or forever home, knowing what goes into a mortgage and getting pre-approved can help you get the edge on other buyers and save a lot of money in the long run. Lock in your interest rate, your term, and your home loan with the ABNB advantage. Contact us to get started today!

Key Features

-

![]() Competitive Rates

Competitive Rates -

![]() Get Pre-Approved

Get Pre-Approved -

![]() Purchase or Refinance

Purchase or Refinance -

![]() Know Your MLOs

Know Your MLOs

Realtors® and Builders

Convert Shoppers Into Buyers

Successful Realtors® and builders’ partner with the experts at ABNB Mortgage for a quick and seamless closing featuring a wide variety of mortgage solutions to fit your client’s budget. Let’s get started today by calling 757.523.5354.

Why ABNB?

Finance your dream home with ABNB knowing that you’ll get an affordable, low-rate mortgage with a variety of terms to fit your needs. Whether it’s your first home purchase or your forever home, we offer a wide variety of mortgage financing options just for you. Our solutions-based approach includes home loans by Fannie Mae, Freddie Mac, FHA, VA, USDA, and a special selection of ABNB exclusive mortgage programs designed just for our members.

As with credit cards and auto loans, mortgages from credit unions like ABNB have many advantages over home loans from BIG banks and online lenders including:

- Fewer fees: As a member, we’re here for you — not the other way around. Thanks to our business structure, we’re able to do more for less, meaning you save money upfront and in the long run.

- Competitive interest rates: On average, credit unions like ABNB offer more competitive interest rates. Even a slightly lower rate can save you hundreds of thousands of dollars over the life of the loan.

- Better member service: You’re not just a number to us. You’re our member. Our employees live, work, and play here and are more attentive to your individual needs.

Diversity, Inclusion and Equality

ABNB is committed to Affordable Housing, and proudly practices Diversity, Inclusion and Equality. Our First-Time Homebuyer program offers no or low-down payment options, provides select grants to help stretch your budget, and gives special consideration for low-to-moderate income borrowers, members in underserved communities, and affordable housing options such as manufactured homes. Our experienced Mortgage Loan Officers will guide you through the available options and help you every step of the way.

Overview

A mortgage loan is simply an agreement between a borrower and a lender, where the lender agrees to loan you money to pay for real estate purchases. Most often, it's for a home. Other times, it's for land, a mobile home, or even an office building. In exchange, you agree to pay that amount of money back plus interest (which is how the lender makes their money).

Affordable Housing Programs

As little as a 3% down payment is needed for First Time Home Buyers earning at or below the Area Median Income (AMI) for Single Family attached or detached homes, townhouses, and qualifying condominiums. In addition, as little as a 5% down payment may be required for Single or Multi-wide Manufactured Homes (minimum Credit Score of 620).

Conventional Home Loans

As little as a 3% down payment may be needed for first-time home buyers without income restrictions or a 5% down payment may be needed if you have owned a home in the previous 3 years (minimum Credit Score of 620).

FHA Mortgages

You may need as little as a 3.50% down payment for 1-4 Family attached or detached homes, townhouses, and qualifying condominiums with this special Federal Housing Administration (FHA) insured mortgage. This program is ideal for borrowers with higher Debt-to-Income (DTI) ratios, limited or challenging credit history, and lower credit scores (minimum Credit Score of 580).

VA Loans

For qualifying veterans and service members, this unique no down payment program insured by the Veterans Administration is one of our most popular and affordable home loans. In addition to 0% down payment required, this mortgage also allows higher Debt-to-Income (DTI) ratios, accepts limited or poor credit history, and lower credit scores (minimum Credit Score of 580).

USDA/RD Home Loans

For borrowers buying a home in designated rural areas and meeting certain qualifying household income, no down payment is required. This USDA Rural Development program allows higher Debt-to-Income (DTI) ratios, accepts limited or challenging credit history, and lower credit scores (minimum Credit Score of 600).

Reverse Mortgages

This is a valuable tool for seniors and can be utilized as a strategy in financial planning for retirement or to improve cash flow. Qualified seniors can pay off their current mortgage and then get a line of credit, receive cash in a lump sum, receive monthly payments, or a combination of any of these. You remain the resident owner of your house and you are also protected if the housing market declines.

Additional Mortgage Options

In addition to the popular programs listed above, we offer many other options for primary residences, vacation homes, and investment properties including those which allow non-traditional income, no tax returns, recent bankruptcy or foreclosure, and other challenges some borrowers face in securing traditional mortgages

Contact an experienced ABNB Mortgage Loan Officer today to realize your dream of home ownership!

Click here to calculate your mortgage payment!

At the bare minimum, every house hunt should start with a pre-qualification. Here's how those work.

| Pre-Qualification | Pre-Approval |

|---|---|

| Consider pre-qualification your official “starting point” in the mortgage process. With a pre-qualification from ABNB, you’ll be able to establish a rough budget for your search. To get a pre-qualification, you’ll submit a few minor details — income and employment, for example — to find out how much you might be able to borrow and at what rate. | This is where your relationship with a lender gets a little more serious. Pre-approvals are perfect for serious buyers who have a home in mind, a real estate agent on hand, and are ready to put in an offer. To obtain a pre-approval, a lender will review your pay stubs, tax returns, debts, and run a credit check before issuing a conditional (not final or guaranteed) offer for financing. |

| GET PRE-QUALIFIED | GET PRE-APPROVED |

Whether you’re buying or refinancing your first, second, or forever home, knowing what goes into a mortgage can help you get the edge on other buyers and save a lot of money in the long run. Contact us to get started today!

At ABNB, we don’t charge points. Zero. Zilch. Nada. That means you could save up to $2,500* when you refinance with us.

If you’ve been in your home for years and have been putting in sweat equity where it counts, it might be time to consider refinancing your mortgage. You’ll benefit from our expedited process and will maximize savings on your monthly mortgage payments.

| Lower your monthly payments | Tap into your equity for cash | Free yourself from PMI |

|---|---|---|

| Refinancing at a lower rate can help decrease your monthly mortgage payment and gives you the flexibility to choose a different term. | A cash-out refinance is a great way to use the equity from your mortgage for home improvements, college expenses and more. | Your home’s value may have increased over time, so refinancing can eliminate PMI and save you even more! |

*Based on 80% LTV with a purchase price of $250,000. All loans subject to approval. Rates, terms, and conditions subject to change, May vary based on creditworthiness and qualifications.

If you need to pay an escrow shortage, please contact our Mortgage Team at 757.523.5354 or email [email protected].

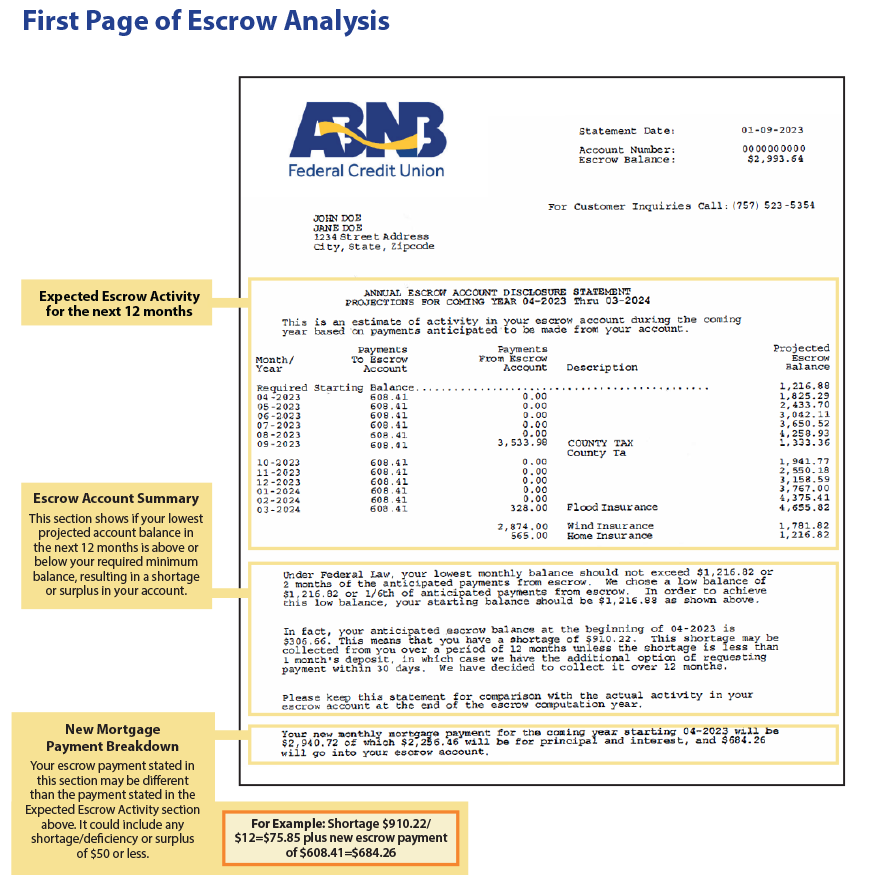

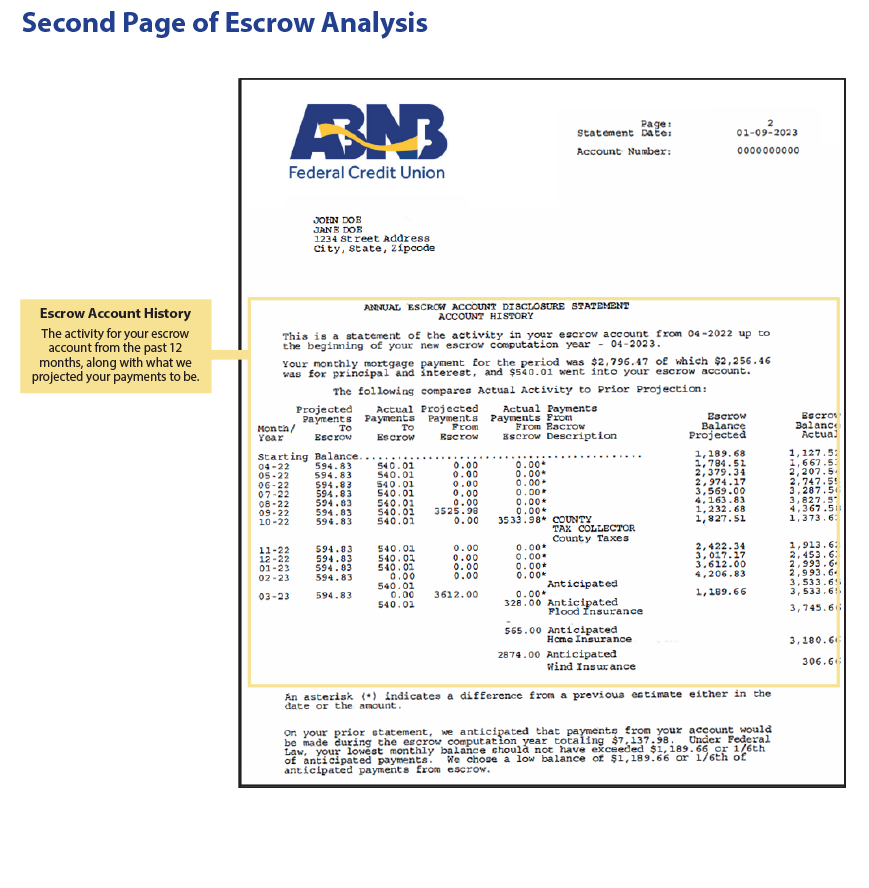

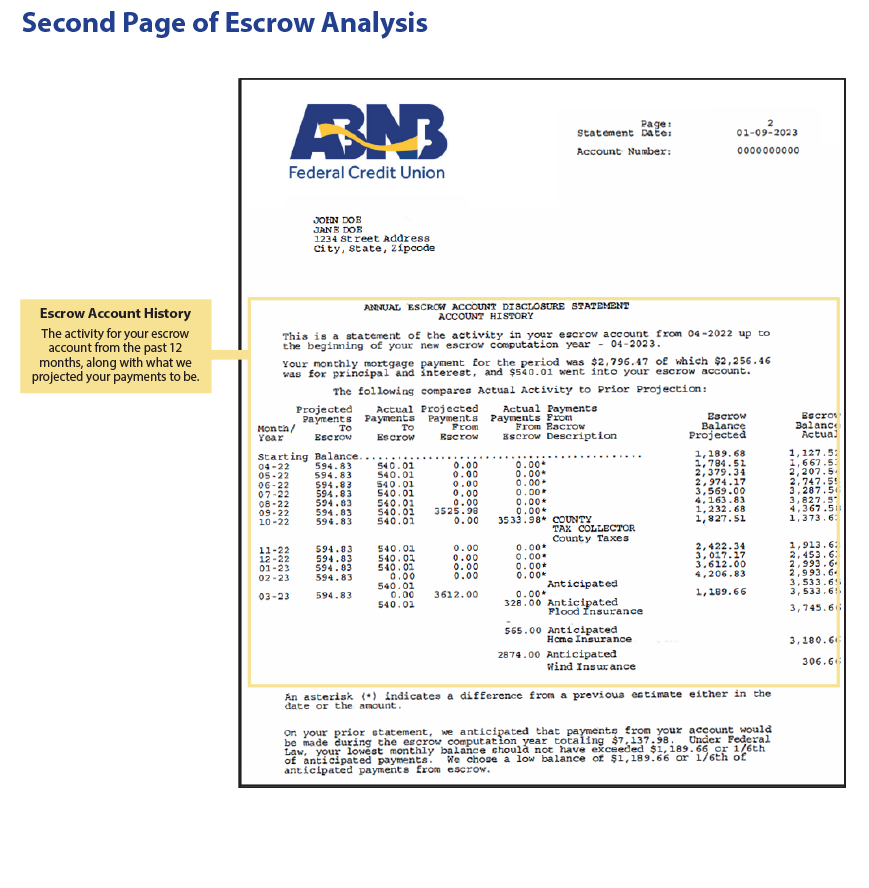

Understanding your escrow analysis statement for your mortgage can be confusing. Luckily, ABNB is here to help. Let’s break it down.

What is escrow and do I have it?

Escrow is an account balance tied to your mortgage loan to pay your escrowed entities whenever they become due. Escrowed entities can include property taxes, insurance, and/or private mortgage insurance (PMI) when applicable. You can tell if you have escrow by reading your disclosure, reviewing your loan payments, or contacting the credit union.

How is my escrow payment calculated? - Escrow payments are calculated by adding the annual amount of escrowed entity’s payments and dividing this amount by 12 (months).

Your escrow analysis statement

First Page - The first page of the statement is your escrow projections for the upcoming year. The credit union reviews your account history with your current monthly payment to determine if your new payment will need to increase or decrease.

Second Page - You’ll see the escrow projections from the previous year. This section shows the differences in your payments from this year compared to last year. This will help you visualize the increase or decrease in your monthly payments.

Third page - A continued overview of the itemized disbursements paid on your behalf.

Surplus, Shortage, Deficiency…What does it all mean?

Now to decipher what it all means. You may see the following words next to a dollar amount on your statement: Surplus, Shortage, and Deficiency.

Surplus means that you paid more than you needed to into your escrow account. Typically, this means that the annual payment for one or more of your escrow entities decreased or remained the same. For example, if your property taxes or homeowners insurance cost decreased from the previous year. That surplus amount goes back directly to you.

Shortage means that you did not pay enough into your escrow account. Typically, this means that one or more of your escrow entities annual payments increased. As your lender, we pay your escrow entities, regardless of your balance. The shortage amount is how much you owe to your escrow account.

Deficiency means that you have shortage, but you are also negative in your escrow account as well. An escrow account requires at least 2 months worth of payments as a cushion, or safety balance. If you have a deficiency, that means you do not have enough money in your escrow account to cover the 2 months of payments and the shortage amount.

Putting It All Together

If you have a shortage or deficiency, that amount will be split into 12 equal amounts and rolled into your escrow payment for the next year.

At the end of your escrow analysis statement there is a recalculation of your escrow payment. If you have a surplus, your monthly payment will decrease if your surplus is $50 or less. If your surplus is more than $50, it will be refunded to you. If you have a shortage or deficiency, your monthly payment will increase.

We hope this has helped you understand more about understanding your escrow account.

If you have any questions, please contact our Mortgage Team at 757.523.5354 or email [email protected].

APR = Annual Percentage Rate. Rates displayed are the lowest rates available for qualified borrowers. Actual rate, APR, and maximum financing options may differ based on loan characteristics and creditworthiness. ARM rates are based on an index and a margin; the index is the one-year constant maturity treasury rate; the margin varies by loan characteristics, such as the amount borrowed, Loan to Value, and creditworthiness. Annual rate cap of 2%; lifetime cap of 6%. Conventional rate assumptions for displayed rates: $400,000 purchase, $320,000 loan amount, 20% down payment, 760 Score, single family detached house in Chesapeake, VA. FHA rate assumptions for displayed rate: $400,000 purchase, $386,000 loan amount plus FHA UFMIP, 3.5% down payment, 680 Score, single family detached house in Chesapeake, VA. VA rate assumptions for displayed rate: $400,000 purchase, $400,000 loan amount plus VA Funding Fee, 0% down payment, 680 Score, single family detached house in Chesapeake, VA for a qualified Active-Duty Military or Veteran borrower. VA jumbo rate assumptions for displayed rate: $1,000,000 purchase, $1,000,000 loan amount plus VA Funding Fee, 0% down payment, 680 Score, single family detached house in Chesapeake, VA for a qualified Active-Duty Military or Veteran borrower. USDA rate assumptions for displayed rate: $400,000 purchase, $400,000 loan amount plus USDA Guarantee Fee, 0% down payment, 680 Score, single family detached house in a USDA designated area in Virginia. ABNB FCU is an Equal Housing Lender.