Make every dollar count.

Enjoy the freedom of earning higher rates on your savings and spend as you see fit with ABNB’s all-access Performance Money Market Account.

Key Features

-

![]() Earn Tiered Dividends

Earn Tiered Dividends -

![]() Instant Access

Instant Access -

![]() Online & Mobile Banking

Online & Mobile Banking

For starters, money market accounts typically come with higher rates than regular savings accounts — meaning you earn more dividends on your deposits. Additionally, a money market account allows instant access to your money at any time.

Certificates are another popular savings option, but require minimum deposits, provide locked-in rates, and have specific terms with penalties for early withdrawals. That means a money market is a great savings option that gives you ultimate flexibility.

Thanks to their flexibility, security, and ability to earn more, Performance Money Market Accounts are ideal savings solutions for emergency funds, large expenses, tax payments and more.

Emergency Funds

Maybe your AC system dies in the heat of the summer, your pet needs emergency surgery, or you might need to pay for unexpected car repairs. Money market accounts can serve as a “secondary” spending account that can be tapped whenever you need it.

Putting aside a small amount of income over time can lead to large gains, which you can use in case of emergencies.

Large Expenses

Planning on buying a house? Thinking about getting married? Hoping to take a much-needed family vacation? Great news! A Performance Money Market Account can help you save for those large expenses, because large balances with high rates lead to larger returns.

Open with an initial deposit, make additional monthly deposits, and reap the rewards of our high rates of return.

Tax Payments

For business owners both large and small, freelancers, or people who just like to be prepared, a Performance Money Market Account can help save for those quarterly/annual tax bills. With an initial deposit of $1,000, you can start earning dividends on your balances.

Additional monthly deposits will also accrue dividends over time, providing you with more cash to use whenever you need it.

|

Pros |

Cons |

|

Federally insured up to $250,000 |

Rates change with the market and may not keep up with inflation |

|

Higher dividends on savings |

Dividends earned on balances over $1,000 |

|

Easy access to cash without penalties, unlike Certificates |

Some MMAs may require minimum balances (but not ours!) |

|

No monthly fees |

Possible monthly fees at the BIG banks |

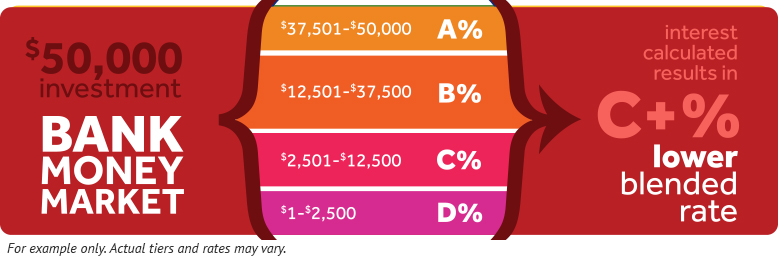

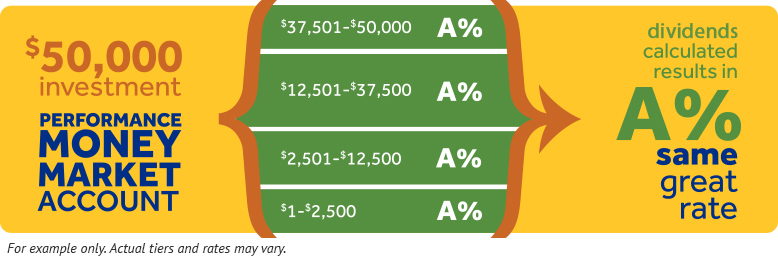

Other banks and credit unions might calculate their money market interest in different tiers, resulting in a “blended” rate of return. That’s not maximizing the return for everyday savers.

At ABNB, earnings are calculated using the highest rate your account balance qualifies for, meaning you earn more dividends on the FULL balance, not just on part of your funds. It’s that simple.

APY = Annual Percentage Yield. Rates effective 02/20/2024 and are subject to change without notice after account opening. $1,000.00 minimum deposit. Dividends calculated by daily balance of at least $1,000.00. No dividend will be earned in any dividend period if daily balance is below $1,000.00. Fees could reduce earnings.